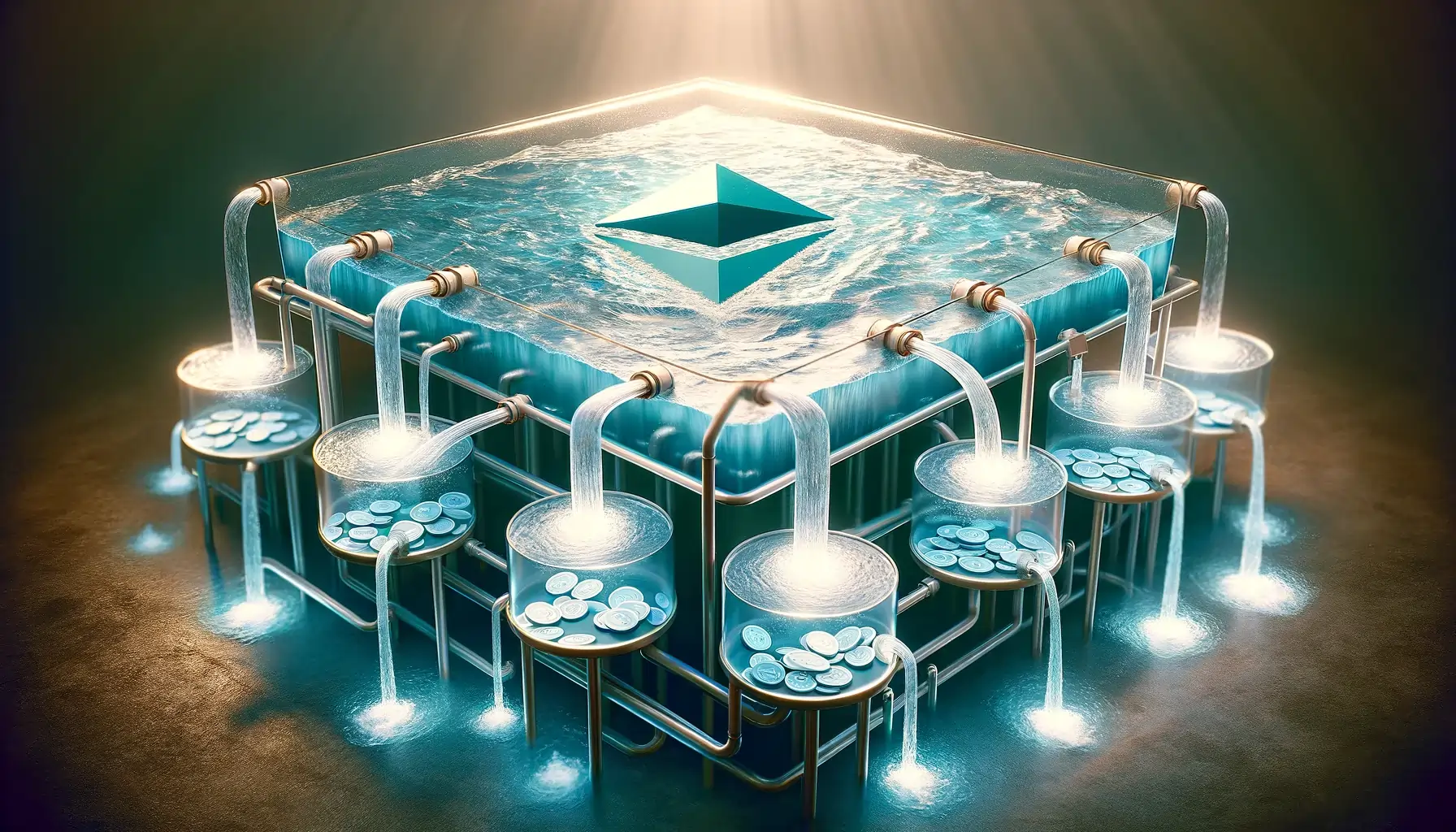

The landscape of Ethereum staking is witnessing a pivotal shift as Lido’s market share declines below the 30% threshold, marking a significant move towards greater decentralization.

With its market share dropping to 29.57% from 32% in December 2023, Lido’s position is being recalibrated amidst an influx of Ether cryptocurrency stakers.

This transition addresses the growing concerns within the community about Lido’s burgeoning influence over the Ethereum ecosystem.

The Competitive Landscape of Ethereum Staking

As of April 4, data from Dune Analytics reveals this shift in market dynamics.

Notably, other key players such as Coinbase, commanding a 14.04% market share, along with Binance and Kiln at 3.75% and 3.5% respectively, are also making significant contributions to Ethereum’s staking environment.

A mysterious “unidentified” entity now holds 16.9% of the market, further diversifying the staking landscape.

The concern that any single entity commanding over a third of the market could wield undue influence over Ethereum’s operational facets has been a point of contention within the community.

Ethereum co-founder Vitalik Buterin has previously stated that stake pools should ideally not exceed a 15% market share, suggesting an increase in fee rates as a potential deterrent to surpassing this limit.

Speculative controversial take: we should legitimize price gouging by top stake pool providers. Like, if a stake pool controls > 15%, it should be accepted and even *expected* for the pool to keep increasing its fee rate until it goes back below 15%. https://t.co/cOtuM7Occd

— vitalik.eth (@VitalikButerin) May 14, 2022

Efforts to Curb Staking Dominance

The Lido decentralized autonomous organization (DAO) once considered implementing a hard cap to its ETH staking dominance.

However, this proposal was overwhelmingly rejected in June 2022, with 99.81% voting against it. This decision underscored the complexity of addressing dominance within the staking ecosystem without stifling growth or innovation.

The Path to Decentralization and the Risks of Restaking

The evolving competitive landscape among ETH staking service providers is anticipated to further decentralize the staking ecosystem.

However, this growth is not without its challenges. A recent report from Coinbase raised potential risks associated with Ether restaking and the issuance of liquid restaking tokens (LRTs).

Specifically, the restaking protocol Eigenlayer was highlighted as an example where restaking could potentially amplify earnings at the expense of elevating risk, due to the allocation of funds to similar validators for increased yield.

The analysts cautioned, “While this (restaking) can increase earnings, it can also compound risks.” They warned that the pursuit of maximized yields by LRTs to gain market share could inadvertently introduce a heightened risk profile, albeit concealed, to stakeholders.

As the Ethereum staking arena continues to evolve, the delicate balance between maximizing returns and mitigating risks remains a central focus for developers, investors, and the broader community alike.