In a pivotal moment for the DeFi sector, Uniswap Labs, the entity behind the leading decentralized exchange (DEX) Uniswap, has found itself in the crosshairs of the United States Securities and Exchange Commission (SEC). The receipt of a Wells notice—a precursor to potential enforcement action—signals a significant regulatory challenge not just for Uniswap but for the broader crypto industry. This development underscores the ongoing friction between innovative DeFi platforms and traditional regulatory frameworks.

Hayden Adams, the founder of Uniswap Labs, took to social media to voice his frustration and determination in the face of the SEC’s recent actions.

Today @Uniswap Labs received a Wells notice from the SEC.

I’m not surprised. Just annoyed, disappointed, and ready to fight.

I am confident that the products we offer are legal and that our work is on the right side of history. But it’s been clear for a while that rather than…

— hayden.eth 🦄 (@haydenzadams) April 10, 2024

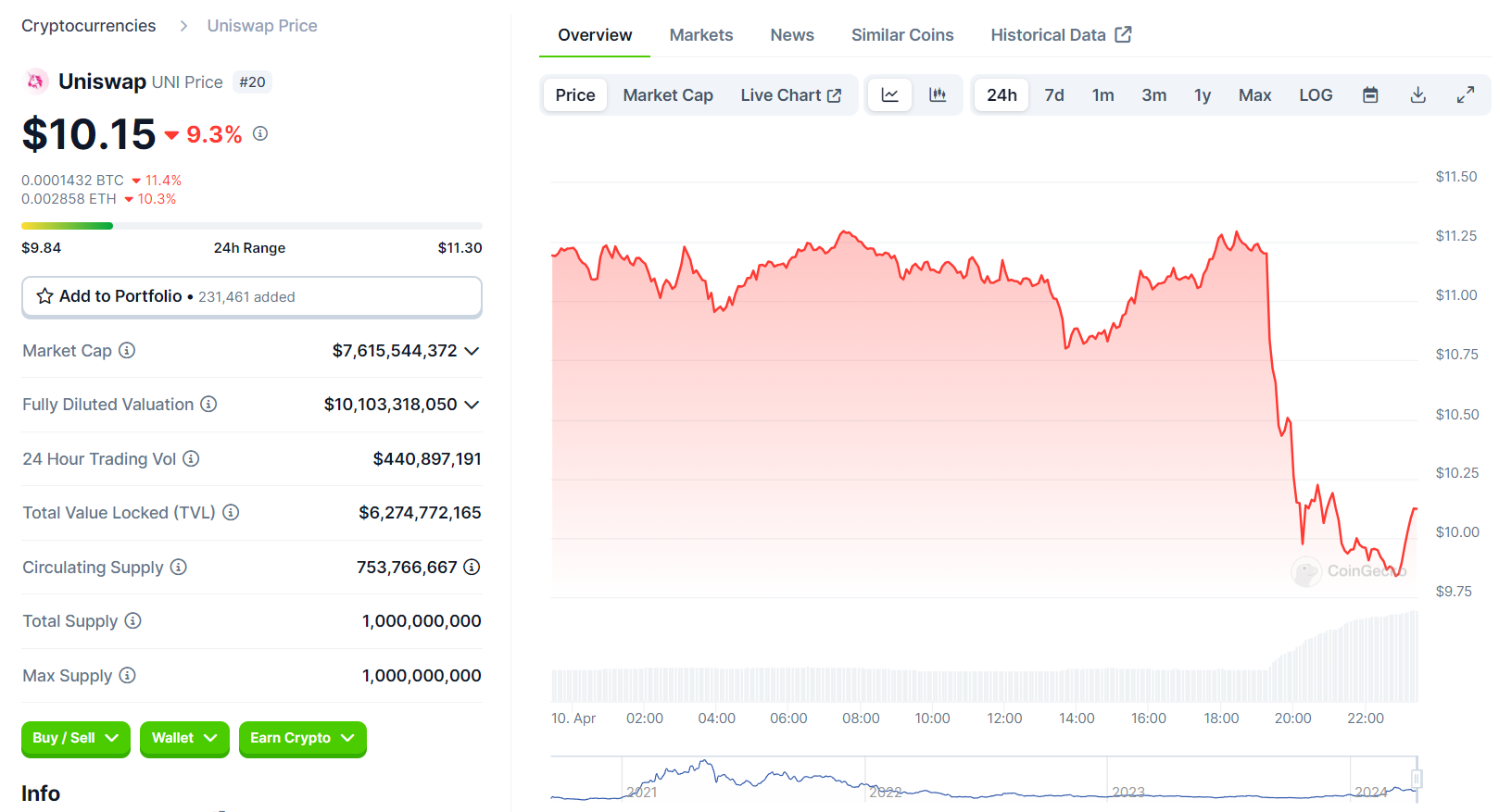

The notice, which centers on allegations of Uniswap acting as an unregistered securities broker and exchange, has ignited a fierce debate over the nature of digital tokens and the applicability of existing securities laws to the DeFi space. The sharp 9.5% drop in Uniswap’s native token, UNI, following the announcement highlights the market’s sensitivity to regulatory news.

Uniswap’s leadership, including COO Mary-Catherine Lader and Chief Legal Officer Marvin Ammori, emphasized their belief in the legality of Uniswap’s operations. They point to the exchange’s foundational role in facilitating transparent, secure, and accessible financial infrastructure as evidence of its positive impact within the technological and financial landscapes.

Uniswap’s Defense and the SEC’s Stance

In response to the SEC’s notice, Uniswap has outlined a vigorous defense, challenging the notion that its operations fall under the SEC’s current definitions of an exchange or broker. The company’s arguments are buoyed by recent judicial rulings favoring similar platforms, suggesting a potential pathway to legal vindication. Despite the uncertain road ahead, Adams’s rallying cry for unity and perseverance reflects a broader sentiment within the DeFi community: a belief in the transformative potential of blockchain technology and a willingness to fight for its future.

On the other side, the SEC’s silence on specific investigations, combined with its broad assertion of jurisdiction over most tokens besides Bitcoin, paints a picture of a regulatory body grappling with the fast-evolving crypto landscape. The agency’s approach, critiqued by some as “regulation via enforcement,” has raised questions about the clarity and fairness of its actions against industry innovators like Uniswap and Coinbase.

This standoff between Uniswap and the SEC is a litmus test for the future of DeFi and crypto regulation in the United States. As Uniswap navigates these challenges, the outcome may set critical precedents for how decentralized technologies are treated under U.S. law. Meanwhile, the European Union’s ongoing efforts to craft bespoke DeFi regulations offer a glimpse into alternative approaches that might balance innovation with investor protection.

As the situation unfolds, the crypto community watches closely, aware that the stakes extend beyond Uniswap to the very heart of the DeFi ethos: the quest for a more open, equitable, and decentralized financial system.